Original Video Link: https://youtu.be/ckik2CCe0w0?si=aT8JqapinFoAVMf4

Context

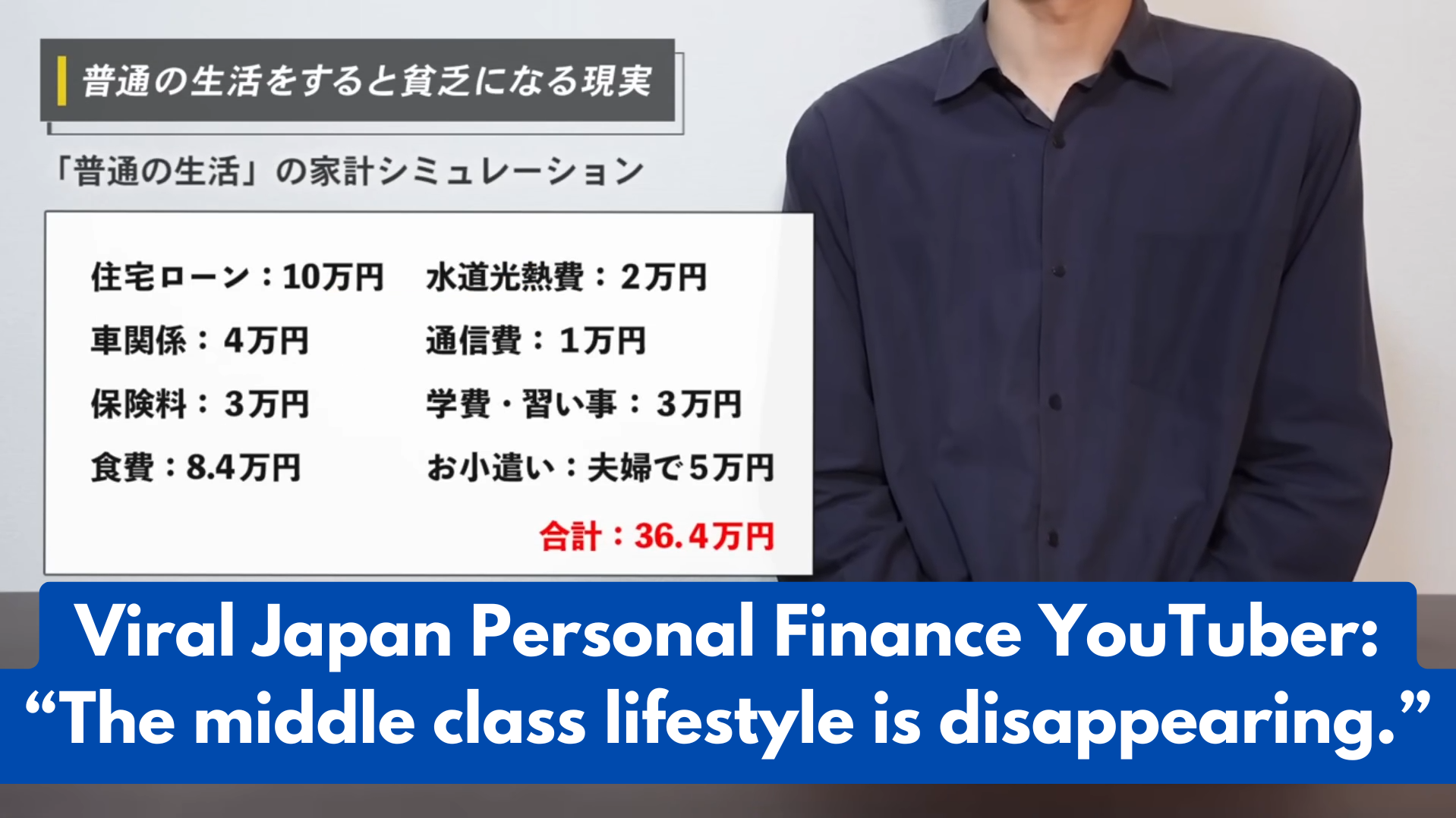

This man who goes by the name Kentaro is a popular personal finance YouTuber in Japan. In this viral video with more than 700,000 views, he explains why the stereotypical middle class lifestyle is no longer possible in today’s Japan due to factors like decreasing average income and rising social security payments. He gives realistic advice on how to survive today’s Japanese economy.

Highlights

- A stereotypical middle-class lifestyle in Japan as depicted in Japanese media is no longer affordable to those making today’s average salaries

- Japan’s worsening economy, stagnant wages, and rising taxes and social security payments have led to the disappearance of the middle class lifestyle

- For the average person to survive today’s Japanese economy, one must carefully evaluate which aspects of the middle class lifestyle one truly wants to pursue since it’s no longer possible to pursue all the elements, including home and car ownership, having children, and sending children to university

Translation

You might assume that a middle class lifestyle includes the following components: working a full-time job, starting a family, buying your own car and home, and sending your kid to university. This is what many assume to be the average middle class life. However, in today’s Japan, when average people try to live this “average” life, they will find that it does not work. This is due to the hopeless current state of our nation and our social structure. If you try to pursue the “average” life without understanding this, both your heart and your wallet will be broken. In this video, I will explain why the “average” lifestyle doesn’t work and how you can survive in today’s harsh conditions.

Why the “average” life doesn’t work anymore

Many assume the average life to include the following: your own home, your own car, about 2 kids, and university education for the kids. This assumption comes from seeing the norm of our parents and grandparents as well as the average family as depicted in the media. However, if you think the average person can achieve this in today’s Japan and Japan in the future, your heart and wallet will be exhausted for 3 reasons.

- Decreasing Income

Japan’s average income hasn’t improved for 2 or 3 decades; it even declined. According to data published by the National Tax Agency, the highest average annual income for the past 30 years was in 1997 at 4.6 million yen. The newest data for 2021 shows that the average annual income is 4.4 million yen. However, the average annual income is pulled down by how many women and seniors work part-time jobs nowadays, which didn’t happen before. Looking at this number alone, we can’t say that Japanese income has decreased. Let’s compare the average annual income of men in their 40s between now and 1997. In 1997, the average annual income of men between 40 and 44 was 6.4 million yen; in 2021, it’s 5.8 million. For men between 45 and 49, the average annual income in 1997 was 6.9 million, and in 2021 it’s 6.3 million. From these numbers, it’s clear that people are paid less today. - Increasing taxes and social security payments

In addition to being paid less, tax and social security payments have increased. This means that your take-home salary has decreased even more than your gross pay. Social security payments have especially increased significantly. Social security payments are comparable to tax, but they are rarely discussed. As a result, social security payments have increased a lot without us noticing. Social security payments have continued to increase since the end of the Showa era. Today, welfare pension takes 18.3% of your salary. Health insurance takes about 10%. After you turn 40, nursing care insurance takes about 1.6%. Although your employer shoulders about half of these payments, it’s taken out of your salary. Whereas income tax and resident tax are calculated in relation to your taxable income, social security payments are calculated in relation to your gross pay, which makes them even heavier burdens than income and resident taxes. In the Showa era and the early Heisei era, social security payments weren’t this expensive. From the perspective of employers, if they increase salaries, they’d have to pay more in social security to the government, so it’s hard for your employers to raise your salary. In other words, as social security payments increased, it has become harder to raise salaries. - Education becoming more expensive

University education has become more and more expensive, which is taking a toll on the average family. In 1975, tuition for public universities was 36,000 yen a year. In 1985, it was 252,000. In 1995, it was 447,600. In 2005, it was 535,800. Today, tuition for private universities is about 930,000 a year. Of course, tuition isn’t the only expense when you go to university. You’d have to pay for textbooks and living alone. In 1994, the average household annual income was 664,200. In 2019, it was 552,300. In addition to social security payments, university tuition has become a lot more burdensome to the average family. Despite this, the percentage of students going to universities has been increasing because many are taking out student loans. This means that when students graduate, they are millions of yen in debt. There is a limited number of high paying jobs out there, and those who fail to get a high paying job will be forced into financial difficulties by student loan payments. Today, for someone from an average family to go to university, they would need to either take out student loans or rely on their parents borrowing money. For the former, the student will need to shoulder the financial risk; for the latter, the parents shoulder the risk of financial difficulties after they become old and retire. For the average person today, it’s impossible to achieve what our parents consider to be the average middle class life.

Simulating why living the “average” middle class life is impossible with numbers

Let’s simulate the monthly expenses for a stereotypical middle class family, which consists of a couple in their 30s or 40s with their own home, 1 car, and 2 kids in primary or middle school. The following theoretical monthly expenses are based on publicly available data:

House loan: 100,000 yen

Utilities: 20,000 yen

Car-related: 40,000 yen

Internet and phone: 10,000 yen

Insurance: 30,000 yen

Education: 30,000 yen

Food: 84,000 yen

Recreational spending for the couple: 50,000 yen

Total: 364,000 yen

Today, the average household annual income is about 5.5 million yen; deducting taxes and social security payments, the take-home amount is about 4.4 million yen. The theoretical monthly expenses simulated above add to about 4.3 million yen a year, which means the family spends as much as it earns and cannot save for the kids’ future education or the couple’s retirement. In the future, we can’t expect that much pension and retirement support from the government. If you try to live this “average” lifestyle, you won’t be able to save any money, and you’d eventually run into difficulties.

How to survive today’s Japan

1. Increase your income

You must understand that in today’s Japan, you need above-average income to afford the stereotypical “average” life; this means that if you want that life, you need to increase your income. This can be accomplished by building a duo-income family where both the husband and the wife work, changing jobs, having side hustles, and working for as long as possible until you are very old. Although the average income in Japan has been decreasing, the number of high income individuals has increased. According to the National Tax Agency, the number of individuals making more than 20 million yen a year has increased from 178,000 in 2000 to 302,000 in 2021. Also, the hurdle for earning from side hustles has become lower, so it’s possible to earn more through putting in more work on the side. By working until you are very old, you can delay taking out pension, which means your pension payments will increase when you retire. For every 1 year you delay, your monthly pension increases by 8.4%. This way, even if you aren’t able to save a lot for retirement when you are young, you can still live comfortably after you retire.

2. Give up on the stereotypical “average” life

Not everyone is capable of increasing their income. I’m not especially talented in anything, so I have decided to give up on pursuing the “average” life since the beginning. Although “giving up” sounds negative, it really isn’t; it’s just about prioritizing what’s important to you. For example, if having your own home is important to you, then you might want to give up on car ownership. If you want to prioritize sending your kids to university, then you can give up on buying a new detached home and just live in an apartment. You just need to be aware that without working extra hard, you won’t be able to have everything associated with the “average” life.

3. Turn your focus to the good things about Japan

Although I have been discussing the bad things about Japan, there are many good things about Japan. When you look at the world, if you are born Japanese, you are already a winner in life compared to other countries. We have good infrastructure and safety. Our food is cheap and high quality. The streets are clean. Healthcare is good. Entertainment has become cheaper; you can watch all the movies and dramas you want for a few hundred yen a month. Honestly, you can live a pretty happy life with little money in Japan. While it’s true that the Japanese economy is getting worse, as long as you live frugally and invest the extra, you should be able to save enough for the long term. There aren’t many countries as good as Japan. There’s no point in thinking about how great the past is. We can’t go back in time, and we should focus on the great things of present day.

Support us with a one-time donation!

Tired of learning about Japan through Western interpretations? Japan Media Review translates Japanese media to show you what Japan is really talking about.

Bluesky Social: @japan-media-review.bsky.social

YouTube: https://www.youtube.com/@JapanMediaReview

Exclusive content on Patreon: https://www.patreon.com/c/JapanMediaReview